september child tax credit payment delayed

Child Tax Credit September Payment Delays Resolved. That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August Child Tax Credit money.

The Covid 19 Pandemic Underscored The Child Tax Credit S Power To Alleviate Family Poverty Urban Institute

We know people depend on receiving these payments on time and we apologize for the delay the IRS said.

. The next Advanced Child Tax payment is due to go out on October 15th. The third payment went out on September 17 We apologize The IRS said. Some families who were expecting a child tax credit payment a week ago still have not received it.

We know people depend on receiving these payments on time and we apologize for the delay. While the latest installment of the 2021 Child Tax Credit payments was issued by the IRS on Sept. IR-2021-188 September 15 2021.

According to the IRS you can use the Child Tax Credit Update Portal to see. In a statement IRS realized that the individuals rely on getting these payments on schedule. Printed checks were slated to be sent to the 17 million taxpayers who didnt provide banking information in July but were held up until mid-August Gov.

Whether or not another IRS glitch is. After the July and August payments the first two in the special 2021 child tax credit payment schedule were made on time the September one is taking longer for some. They also apologized for the.

The third payment went out on September 17 We apologize The IRS said. Families receiving their first monthly payment in September will still receive their total advance payment for the year up to 1800 for each child under six and 1500 for each. The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17.

The IRS explained Friday why some September child tax credit payments may be less and why some payments went out late. 15 some families are getting anxious that they have yet to receive the money. Your recurring monthly payments shouldve hit your bank account on the 15th of each month through December.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. We know people depend on receiving these payments on time and we apologize for the delay. The expanded child tax credit pays up to 300 per child ages 5 and.

Chris Walker 37 a journalist in Madison Wisconsin told CBS MoneyWatch he was expecting a 250 Child Tax Credit payment for his 13-year-old son to land in his account by. One of the questions trending on Google Friday. By Natalie Dreier Cox Media Group National Content Desk September 22 2021 at 857 am CDT.

The September deposit is late. Some parents are reporting that they have not yet received the September Child.

Irs Some Child Tax Credit Payments Delayed

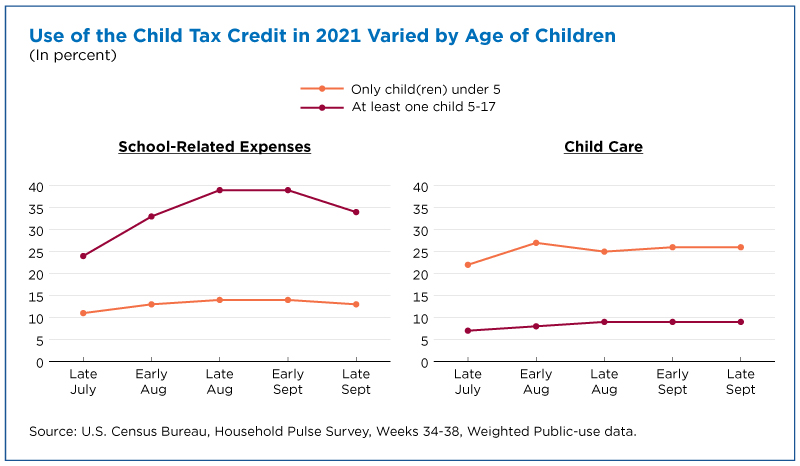

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Stimulus Update Some Families Are Still Waiting On September Child Tax Credit Payment

Some September Child Tax Credit Payments Delayed

Child Tax Credit Where S My September Payment

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credits September Payments Go Out Soon What To Do If You Don T Get One Wgn Tv

Updateportal Twitter Search Twitter

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

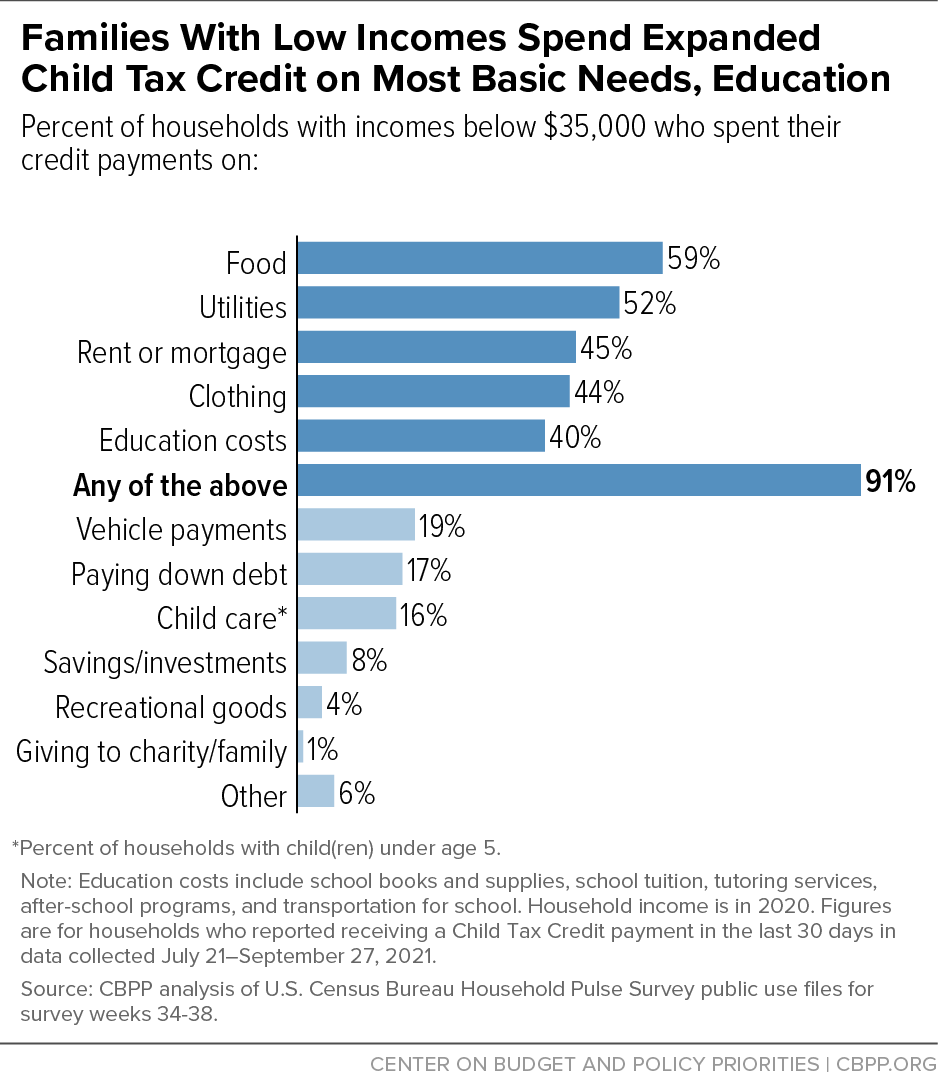

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Biden S Child Tax Credit Pays Big In Republican States Popular With Voters Reuters

Child Tax Credit Irs Treasury Send 15 Billion In Payments To Families

/cloudfront-us-east-1.images.arcpublishing.com/gray/KNUKXEQVVFHXFCIDCNVOW7SL5M.jpg)

Irs Some Child Tax Credit Payments Delayed

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

9 In 10 Families With Low Incomes Are Using Child Tax Credits To Pay For Necessities Education Center On Budget And Policy Priorities